February 15, 2009 by Saud

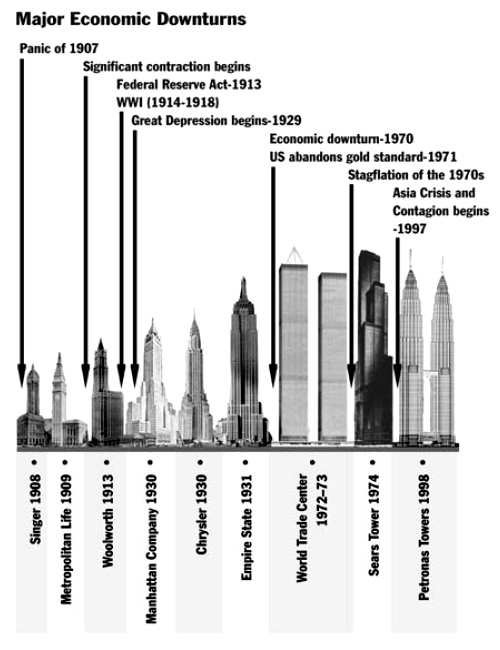

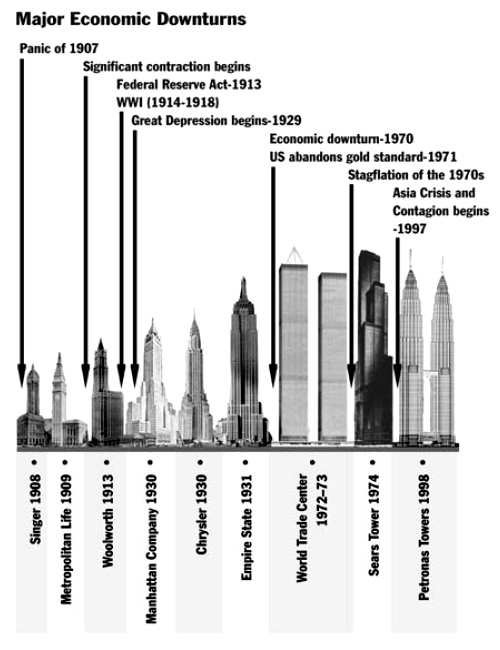

Economist Andrew Lawrence came up with the Skyscraper’s Index which shows the correlation between the construction of the world tallest buildings and economic cycles. His thesis is that in years in which the tallest building is complete or near completion, the economy downturns. To me it seems really odd and I can’t find any reason behind this correlation or coincidence; I guess this is what they call in regression analysis a Spurious Correlation, where observation are correlated completely by chance.

| Building Completed | Name of Building | Location | Hight | Stories | Economic Downturn |

| 1908 | Singer | New York | 612 ft. | 48 | Panic of 1907 |

| 1909 | Metropolitan | New York | 700 ft. | 50 | Panic of 1907 |

| 1912 | Woolworth | New York | 792 ft. | 57 | - |

| 1929 | 40 Wall Street | New York | 927 ft. | 71 | Great Depression |

| 1930 | Chrysler | New York | 1,046 ft. | 77 | Great Depression |

| 1931 | Empire State | New York | 1,250 ft. | 102 | Great Depression |

| 1972/3 | World Trade Center | New York | 1,368 ft. | 110 | 1070s stagflation |

| 1974 | Sears Tower | Chicago | 1,450 ft. | 110 | 1070s stagflation |

| 1997 | Petronas | Kuala Lumpur | 1,483 ft. | 88 | East Asian |

| 2009 | Burj Dubai | Dubai | 2,684 ft. | 167 | Global Financial Crises |

| 2012* | Shanghai | Shanghai | 1,509 ft. | 94 | China? |

* I’m not sure whether Burj Dubai will actually be completed or not, so who knows maybe Shanghai building will be the tallest building by 2012.

|

|

No comments:

Post a Comment